Top 5 Applications of Data Analytics in Banking Spin Analytics and

Banking Analytics Reimagining the Way Banks Do Business

We enable digital transformation by offering a bank-wide perspective of every customer using advanced AI and Analytics. By utilising meaningful insights, SAS allows banks to deliver what customers really need in the moments that matter most. However, the future of banking goes beyond the front end of customer experience, requiring a deep.

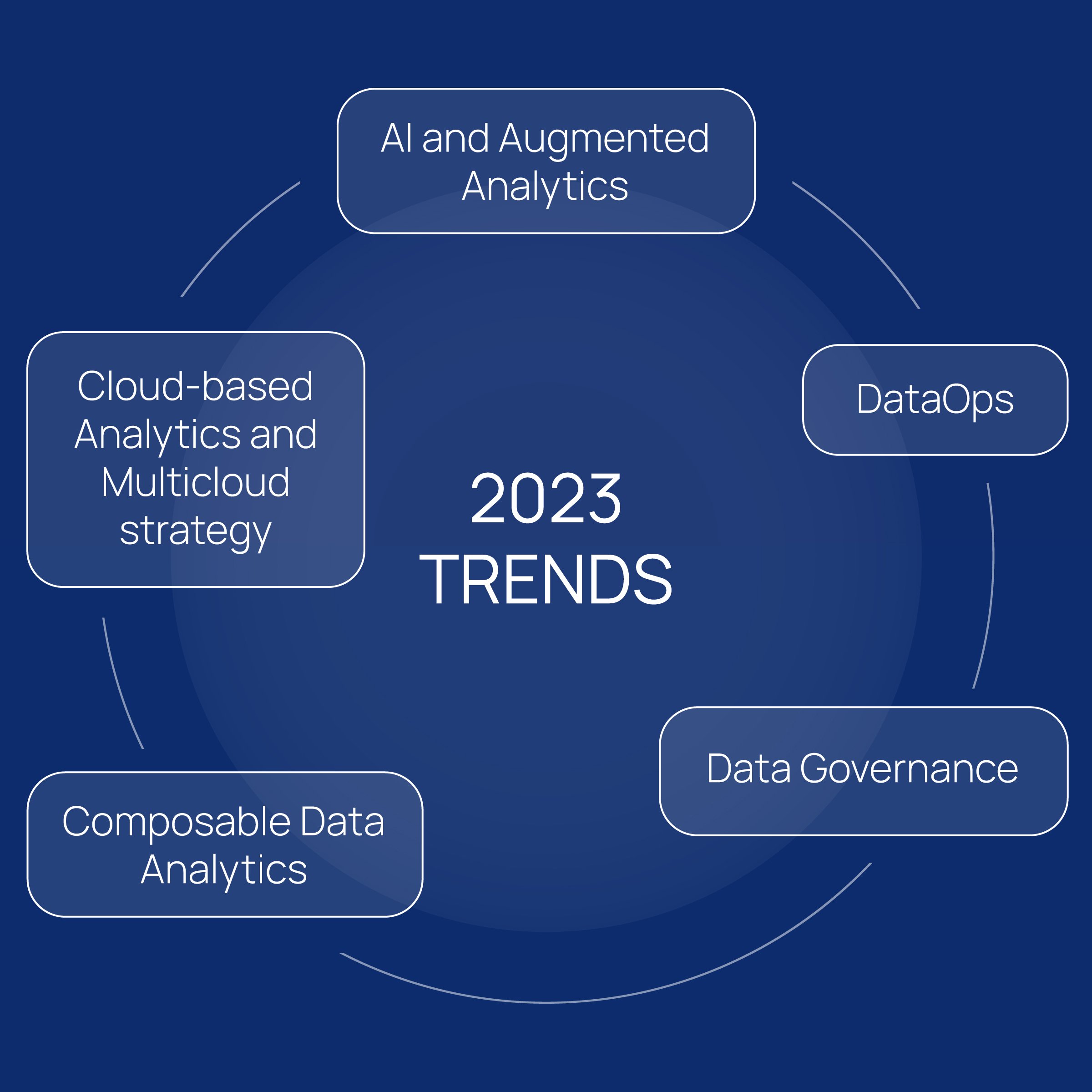

TreasurUp The Leading Analytics Trends for Banks in 2023

The 6 Definitive Data Analytics Use Cases in Banking and Financial Services. Financial services organizations were traditionally product-centric, but they turned to be customer-centric with the evolving tech landscape. Digital transformation in financial services is more profound than leveraging data and digitization.

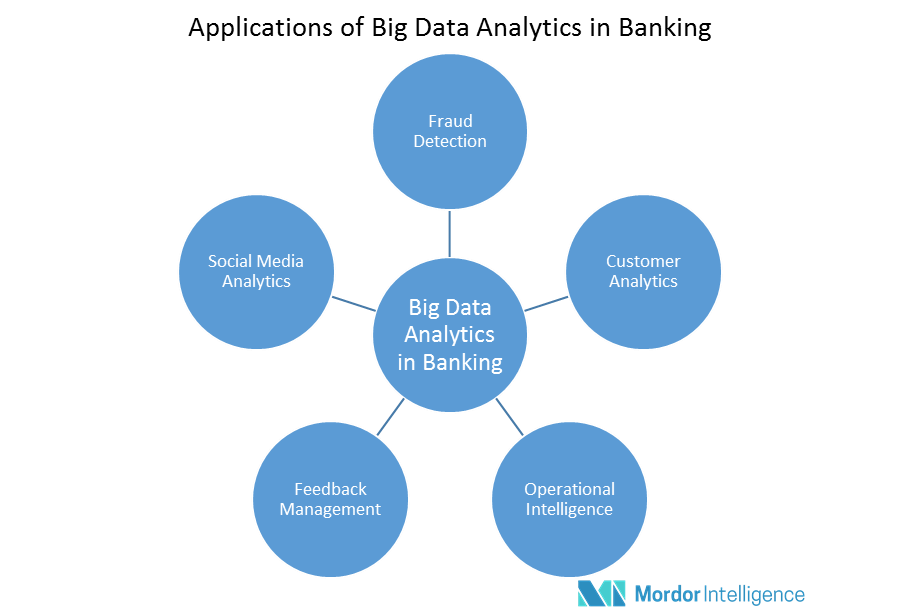

Big data analytics in banking sector all you need to know

Data analytics can help banks undergo more sophisticated key performance indicator (KPI) comparisons with their peers, not just at an aggregate national or statewide banks level, but even a more narrow comparison into a specific asset size. Using call report information, banks can do a point-in-time KPI comparison but also look at year-over.

Data Analytics in Online Banking

Big data allows the banking industry to create individualized customer profiles that help decrease the pains and gaps between bankers and their clients. Big data analytics allows banks to examine large sets of data to find patterns in customer behavior and preferences. Some of this data includes s ocial media behavior. Demographic information.

Data Analytics Use Cases in Banking and Financial Services

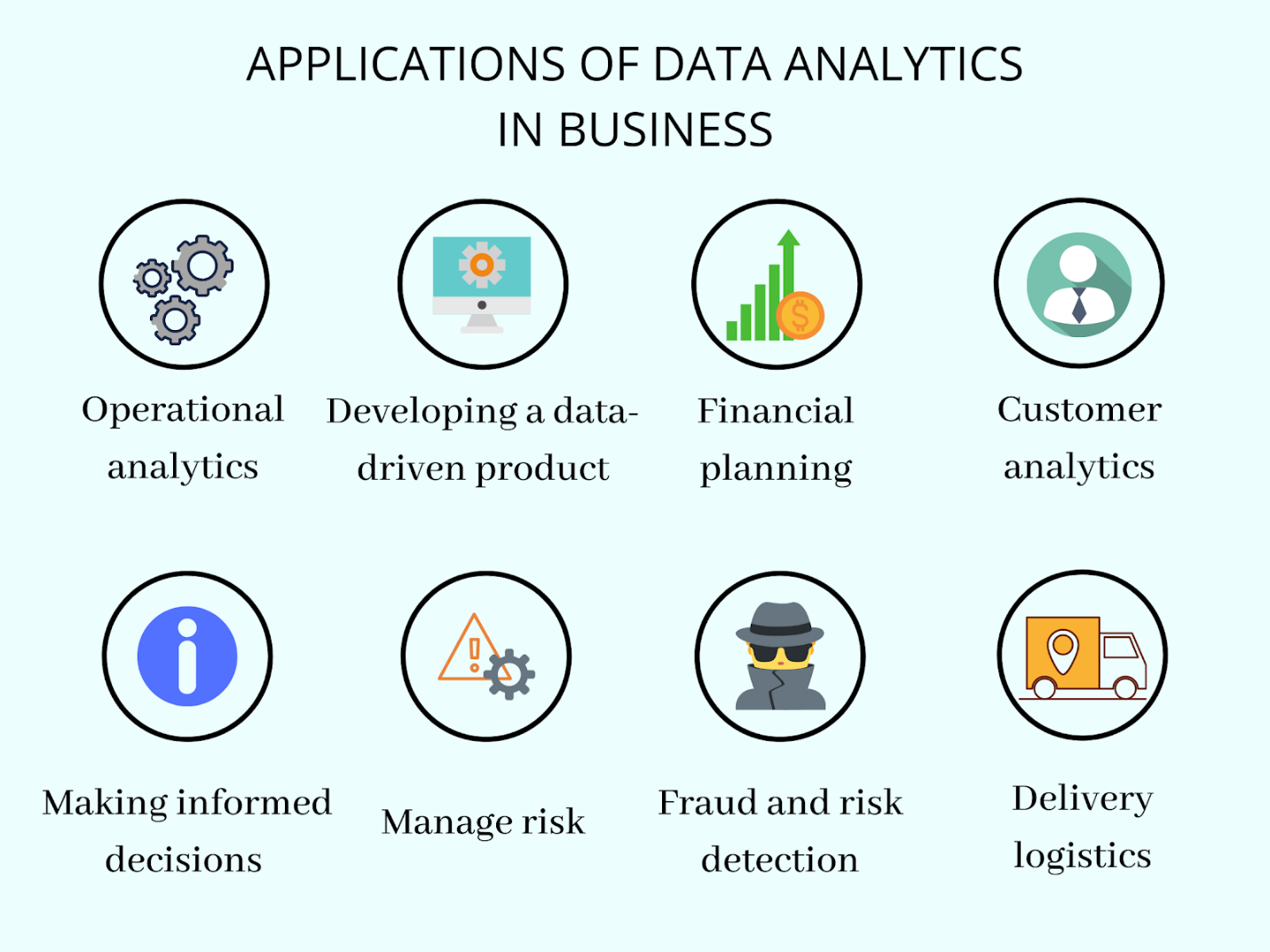

Modern data analytics has transformed the banking industry, enabling institutions to make more informed decisions, continuously improve the customer experience, and enhance their services. Here are just a few examples of how you might leverage modern data analytics in banking: Customer Segmentation.

How can data analytics help your business grow? Blogs Sigma Magic

McKinsey estimates that sharpening analytics efforts could lead to an increase in earnings of as much as $1 trillion annually for the global banking industry. The benefits would be widespread, but about one-third of the gains would come in reduced fraud losses and about 20 percent from better informed pricing and promotion.

The Role of Data Analytics in Banking Lead Generation by Leadzen.ai

This study researches on the Business Analytics in the Industry of Banking and the main focus is given to IBM Cognos and Tableau platforms.. Big Data Analytics, Business Intelligence, Risk.

Top Six Applications of Data Analytics in Banking Soulpage IT Solutions

A clear strategy centered on high-priority applications. Three elements are essential to the strategy. First, banks need an analytics-ready mind-set. Analytics transforms everyday work in surprising ways, so leaders must open their minds to the possibilities. Our core beliefs about advanced analytics can help. 2.

Big Data Analytics in Banking Market Growth, Trends and Forecast

The increasing interest in the use of data analytics in the banking industry is due to the increased changes that have been happening in this sector. Changes in technology, changes in people's expectations, and changes in market structure and behavior.. Along with a case study on how Zuci Systems helped a 100-year-old bank with data.

Why Analytics in Banking Industry is important? Big data, Big data

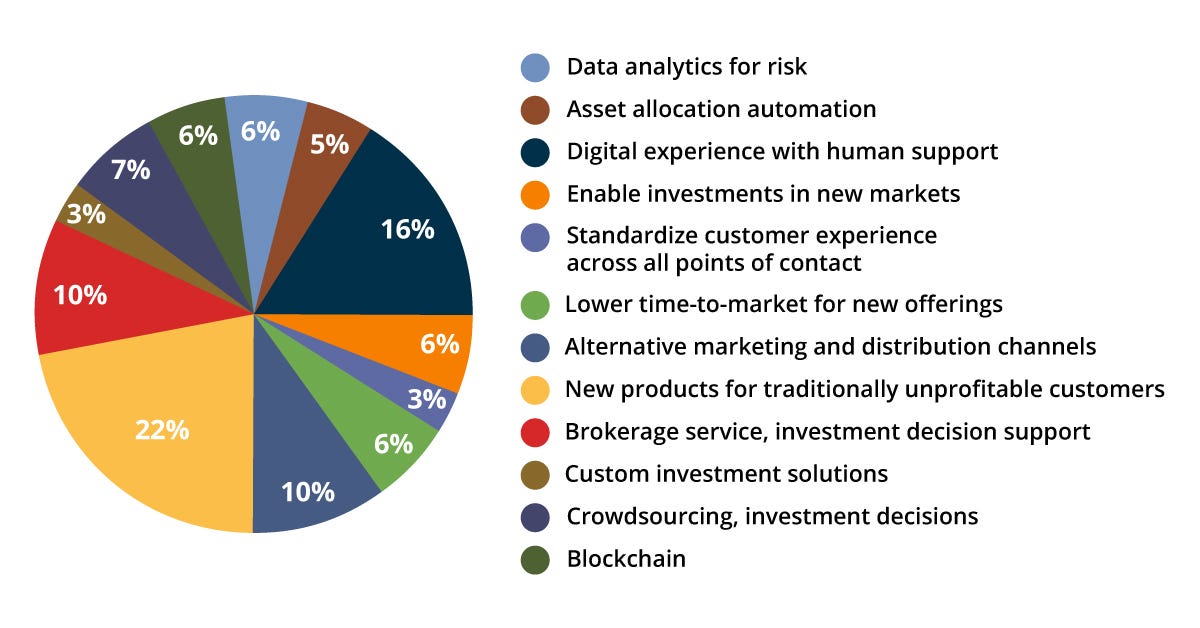

The vast majority of banking and financial firms globally believe that the use of insight and analytics creates a competitive advantage. The industry also realises that it is sitting on a vast reservoir of data, and insights can be leveraged for product development, personalised marketing and advisory benefits.

Your Goto Guide to Big Data Analytics in Banking Hitachi Solutions

In banking, data analytics involves systematically using data and quantitative analysis techniques to understand customer behavior, identify trends, mitigate risks, and uncover opportunities for growth. Banks and fixancial institutions generate and process vast amounts of data daily, from customer transactions and account details to market.

Top 5 Applications of Data Analytics in Banking Spin Analytics and

Data analytics has been integral to the way banks and other financial institutions do business for some time now; in fact, the financial services industry as a whole was one of the earliest adopters of analytics, having used it to monitor and anticipate sudden changes in the market. Nowadays, banks need to leverage banking analytics to derive.

Top 5 Applications of Data Analytics in Banking Spin Analytics and

Data Analytics in the Financial Services Industry. Today's financial institutions have been compelled to deploy analytics and data-driven capabilities to increase growth and profitability, to lower costs and improve efficiencies, to drive digital transformation, and to support risk and regulatory compliance priorities.

Big Data analytics in the banking sector by Vladimir Fedak Data

With revenues of $2.3 trillion, corporate and commercial banking accounts for a significant share of total global banking revenues (Exhibit 1). In the United States, for instance, corporate and commercial banking revenues have advanced at double the rate of GDP growth. 1 Federal Reserve Bank of St. Louis; IHS Global Insight; McKinsey Panorama—Global Banking Pools.

Big Data analytics in the banking sector by Vladimir Fedak

Recent advances in data analytics and machine learning are providing banks with powerful new tools for gaining insights into their customers' needs and behaviors.. The Current State of Data Science in Banking. Industry observations suggest a growing number of banks recognize the potential value of advanced analytics and are actively pursuing.

Big data analytics in banking sector

As a result, data analytics is experiencing a surge in demand, fueled by the widespread adoption of AI, ML, and other data-driven solutions. The global market for big data analytics in the banking industry alone is projected to reach $24.28 million by 2029. This astronomical figure highlights the transformative potential that data analytics.

.